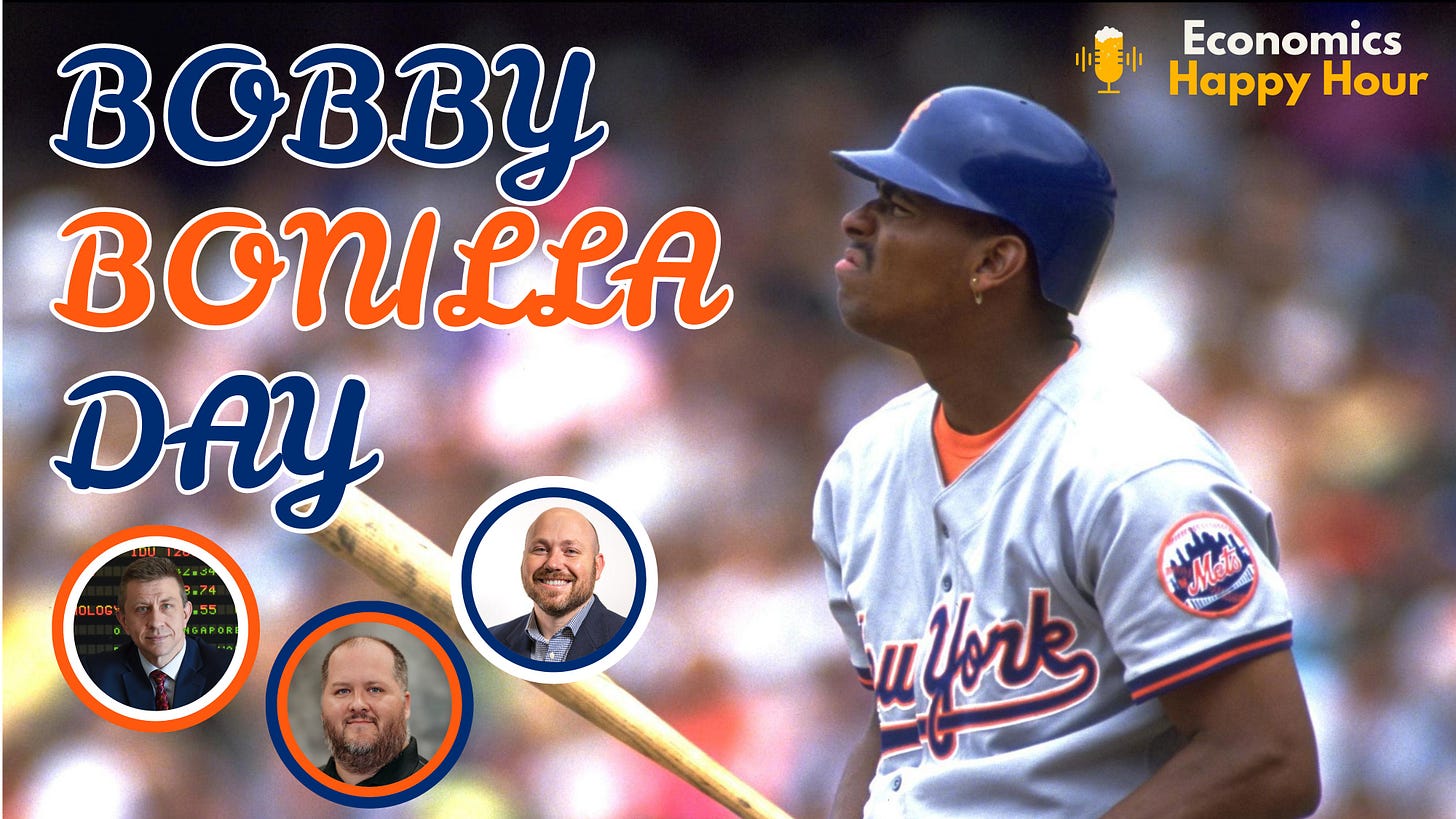

In this episode, we explore the economic concepts behind Bobby Bonilla Day, when the former MLB player annually receives a $1.19 million check from the Mets even though he hasn’t been on the roster since 1999. We unpack how deferred compensation works and whether the Mets’ decision makes financial sense. We dive into annuities, interest rates, and the assumptions that shape financial decisions. Using behavioral economics and finance concepts, we ask: Was this a smart move for The Mets and for Bonilla, and what lessons can we take from it?

In this episode, we discuss:

Why the Mets agreed to pay Bobby Bonilla for 25 years instead of a lump sum

The role Bernie Madoff’s scheme played in the Mets’ financial decisions

What makes annuities appealing for athletes and retirees

The behavioral economics behind protecting money from ourselves

And a whole lot more!

Catch up on some old episodes:

You can also listen to us on Google Podcasts, TuneIn Radio, and Apple Podcasts. If one of these is your go-to podcast service, be sure to rate us and subscribe!

Watch this episode on YouTube:

Some show notes:

There’s a heatwave across the United States, so all of today’s beverages were nice and cold. Matt enjoyed a Moscow Mule to beat the heat, and Jadrian cleared out his fridge with an Almost Famous Pickle Beer from East End Brewing. We’re joined this week by Eric Dunaway from Wabash College to talk about today’s topic. He’s opted for a Mountain Dew Summer Freeze Zero Sugar. Long-time listeners may remember Eric from a few years ago when he joined us to talk about the economics of poker.

What Poker Can Teach Us About Economics (#22)

Jadrian and Matt recorded their final episode from the JET SET conference - this one with Eric Dunaway from Wabash College. During the conference, we learned that Eric teaches a really interesting class on poker at Wabash, and he was gracious enough to sit down with us for a half hour to talk about his class and poker more broadly. He has some fascinati…

Bobby Bonilla Day is more than a quirky sports headline; it's an ideal chance to talk about annuities and deferred compensation. Let’s lay out the story first. It’s 2000, and the New York Mets owe Bonilla $5.9 million. Instead of paying him outright, they get Bonilla to agree to defer his payment for 10 years and then pay him $1.19 million annually from 2011 to 2035. That arrangement totals nearly $30 million, far more than the original sum. Why would the Mets do this?

The logic at the time was based on interest rates and investment expectations. The Mets assumed they could earn 12% on their other investments, which was much more than the 8% implied by Bonilla’s annuity. Unfortunately, their confidence came from Bernie Madoff’s fraudulent returns. When that Ponzi scheme collapsed, so did the rationale behind the deal. The Mets tried to fold Bonilla’s contract into their Madoff litigation, but a judge dismissed the attempt.

The deal highlights why annuities are valuable. Bonilla secured a guaranteed stream of income, starting at age 47 and continuing until he’s 72. This protects against the risk of outliving savings or making poor investment choices, especially relevant given how often athletes struggle financially post-retirement. From a personal finance standpoint, Bonilla’s deal has aged well.

But for the Mets, who didn’t earn the returns they were expecting, why not just buy out the rest of the annuity and be done with it? One possible explanation is that the yearly payment is small relative to their total payroll, and the team’s current owner is a billionaire. It’s likely just easier for both sides to let the payments continue and reap the benefits of yearly publicity.

This week’s pop culture references:

We leaned into the baseball theme with a discussion of our favorite baseball movies. Because we’re good economists, we need to mention Moneyball, but that isn’t our favorite baseball movie. Eric and Matt both picked Major League, while Jadrian went with A League of Their Own.

The episode also featured some pop culture tie-ins to the financial side of the story. Matt recommended Black Edge, a book about Mets owner Steve Cohen, and The Wizard of Lies, which dives into the life and scandal of Bernie Madoff, both key figures in the backdrop of the Bobby Bonilla contract.

Share this post