In this episode, we discuss different economic concepts related to income taxes. Taxes are a fundamental part of our society, and understanding how they work is crucial for making informed decisions about public policy. We explore several key concepts in taxation: regressive and progressive taxes. We'll also take a closer look at marginal tax rates, which play a critical role in determining the amount of taxes paid by individuals and businesses. By the end of this podcast, you'll have a better understanding of the economic principles underlying income taxes and their impact on society. So sit back, relax, and join us as we delve into the world of taxation!

In this episode, we discuss:

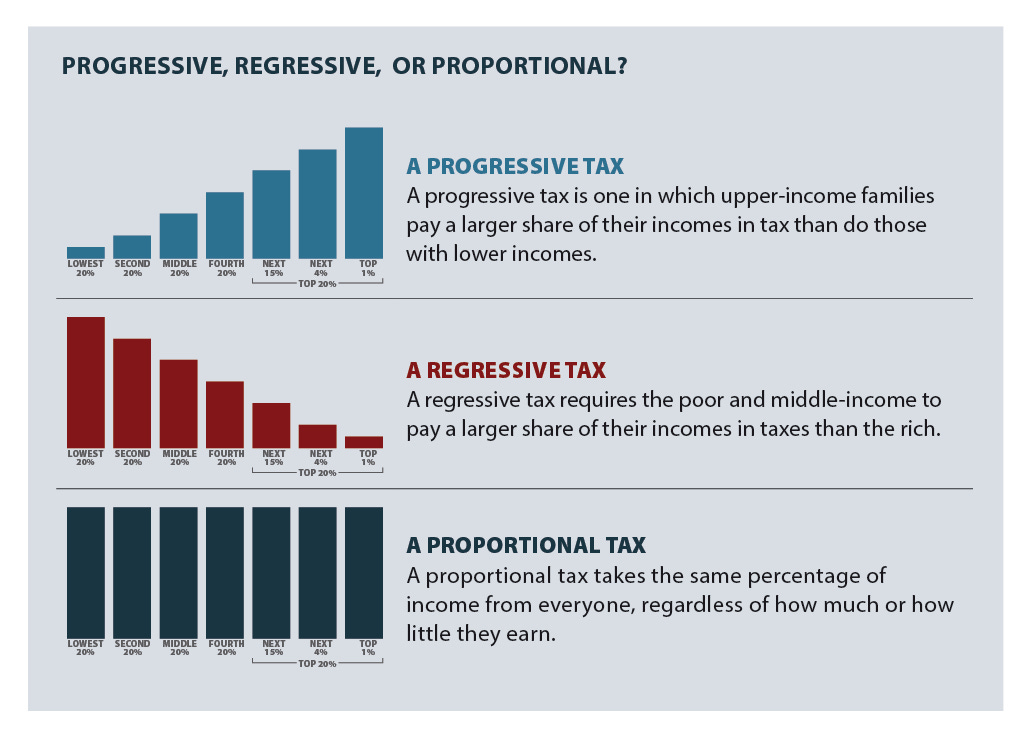

The differences and examples between regressive, proportional, and progressive taxes

Discussion of the pros and cons of different tax systems

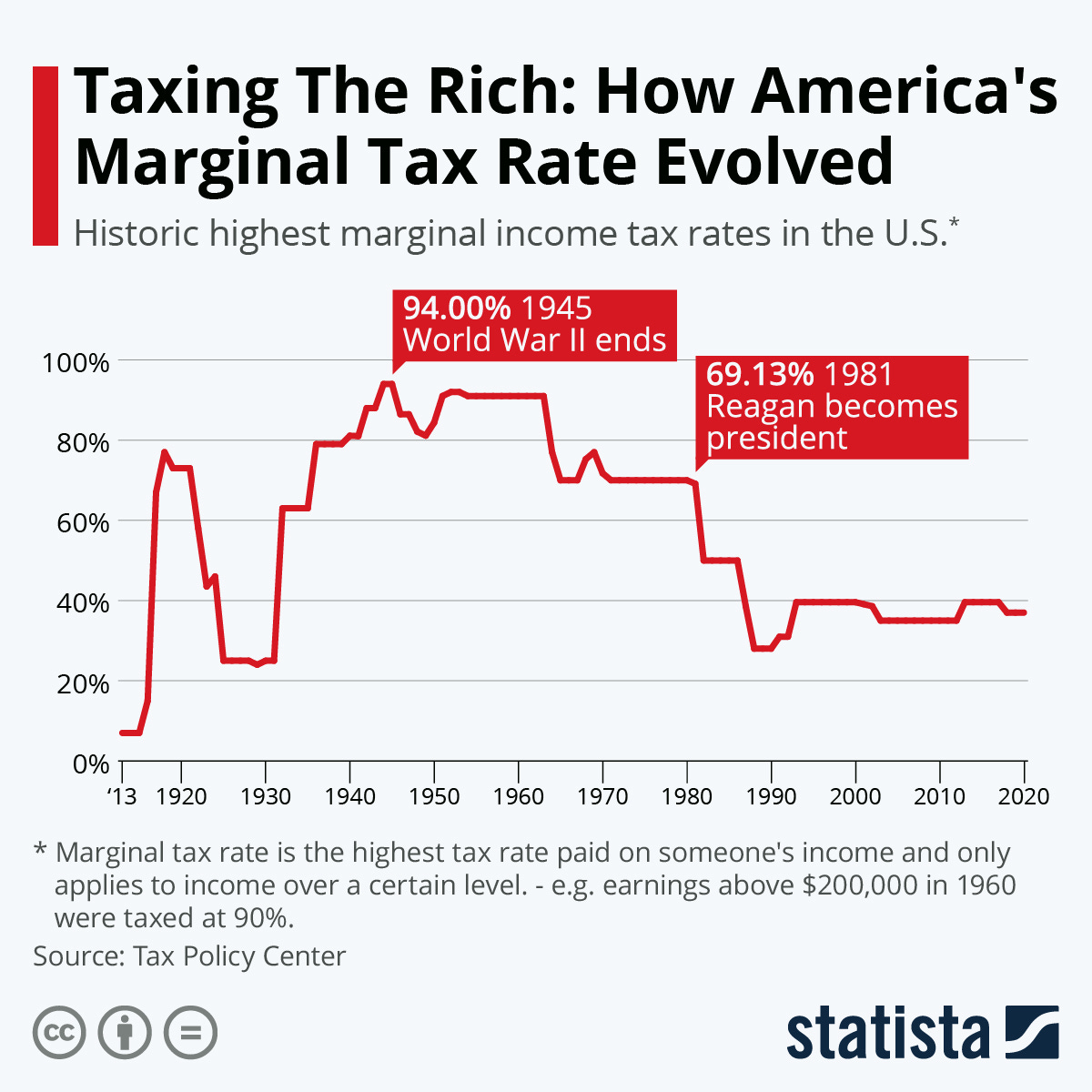

Explanation of marginal tax rates and how they work

The deadweight loss associated with the (complexity of) our current tax system

Pop culture references related to taxes

Watch this episode on YouTube:

Some show notes:

Matt starts by discussing his attempt at a standing desk. Note - in reviewing he notes the sound quality wasn’t as good - which means he was too far from the microphone, which will be corrected if this is attempted again. Jadrian was drinking the Blackberry Gose from Three Notch’d Brewing Company in Charlottesville, Virginia. Matt had the Philadelphia Pale Ale from Yards Brewing Company.

We kicked it off by describing the different types of taxes that exist: progressive, regressive, and proportional (flat) taxes. Here’s a great image from the Institute on Taxation and Economic Policy on the differences:

We also chatted about marginal tax rates and how confusing they can be for a lot of people. The concept is that your tax rate increases as you earn more money, but only on a marginal basis. Vox put together a great explainer of how marginal taxes work:

Most of our debate was on the top marginal tax rates and whether all the exemptions are really necessary. While there is a lot of frustration about what earners at the bottom end of the distribution are (or are not) paying, most debates center on the top marginal tax rate that affects high-earning individuals. We currently have 7 different tax brackets, but back in 1945, there were 24 different tax brackets! Earners at the top of the bracket back in 1945 owed 94% of any earned income above $200,000 to the government. While that threshold seems low by today’s standards, that would be the equivalent of someone earning around $3.25 million per year today. Here’s how the top marginal tax rate has changed over the decades:

This week’s pop culture references:

Jadrian discusses a proposal by Bill Gates that asked if firms should be taxed on robots/machinery. It’s a thought-provoking proposal that Matt and Jadrian discuss. Here’s the video from Quartz, but let us know what you think in the comments:

Matt first discussed a classic Beatles song, Taxman, which has the “one for you nineteen for me” on the progressive tax system. It’s a great song on its own, but even better when it has some use in an economics classroom:

Jadrian then reminded Matt that he had mentioned a couple of months ago another clip that would be great, where Alex P. Keaton from the 1980s comedy Family Ties teaches preschoolers about how to run a business and taxes.

Like, share, and comment!

Enjoyed today’s episode? Share it with your friends! Economics Happy Hour is a free podcast and this post is freely available to readers on Substack. Share away! We would also love to hear from you so leave a comment! If there are topics you want us to talk about, please let us know.

Share this post