In this week’s episode, we talk about some of the intricacies of the Earned Income Tax Credit (EITC), particularly in its role as a tax credit for low to moderate-income individuals or couples. Unlike traditional welfare programs, the EITC has an automatic qualification process, and the potential refund acts as an incentive to work. As a result, the EITC largely receives bipartisan support each time it’s up for renewal. There are some potential drawbacks to the program, but we’ll talk about that in the show.

In this episode, we discuss:

The benefits of the Earned Income Tax Credit (EITC)

The drawbacks of the EITC

The potential for the EITC to replace the entire welfare system

And a whole lot more!

Catch up on some old episodes:

You can also listen to us on Google Podcasts, TuneIn Radio, and Apple Podcasts. If one of these is your go-to podcast service, be sure to rate us and subscribe!

Watch this episode on YouTube:

Some show notes:

Matt and Jadrian are in the thick of the semester, so they’re digging in the back of the fridge to help them get through the week. Jadrian has unearthed a Fruit Punch IPA by Voodoo Ranger from the back of his fridge and Matt is going with a non-alcoholic IPA from The Athletic. First sips, we’re both happy with our beers. We’ll see if that changes by the end of the show.

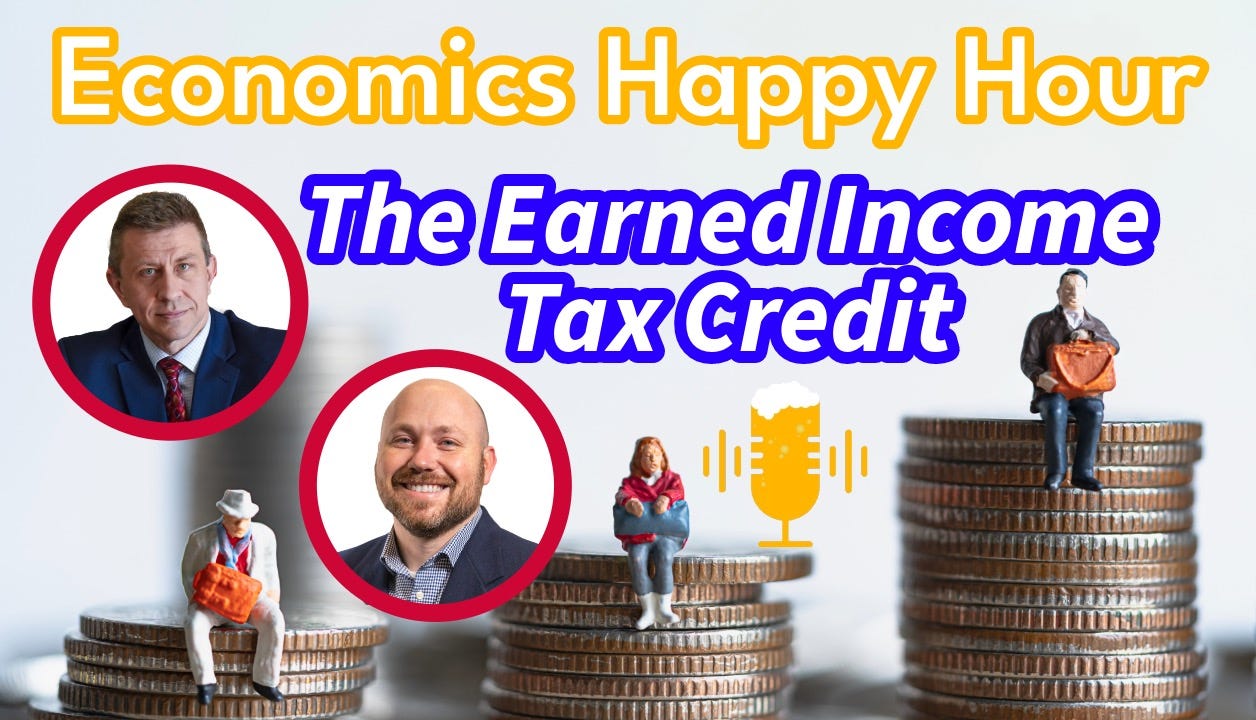

It’s tax season, so we figured we’d talk about a popular tax credit that many Americans are looking forward to: the Earned Income Tax Credit (EITC). This tax credit is intended for low to moderate-income workers particularly those with children. What’s interesting about the design of the tax credit is the potential credit increases as individuals earn more income, serving as an incentive to work. At a certain point, however, that credit decreases more similarly to other means-tested programs.

While Matt & Jadrian love the automatic qualification process, there are some administrative burdens and unintended consequences around most welfare programs in the United States. Matt & Jadrian spend a large portion of the episode discussing the pros and cons of the EITC and what they would like to see done differently if the EITC were expanded to replace other programs.

This week’s pop culture references:

Rather than immediately introducing fresh pop culture ideas, Matt and Jadrian provide an update on a previously mentioned project. They were previously working on a paper exploring economic themes in Taylor Swift songs, which they had teased in earlier episodes. After discovering other individuals already progressing with similar projects, they concluded it was best for them to call it quits. If you want to learn more, check out Swiftonomics and Swiftynomics instead.

Matt (re)visits a memorable scene from Family Ties, where Alex Keaton teaches preschoolers about business operations. The scene concludes with Keaton advising the children to hire an accountant to minimize tax obligations. When questioned about taxes, Keaton humorously describes them as a "terrible, hairy, liberal monster with big teeth.”

Jadrian’s contribution focuses on the complexities of the U.S. tax filing system, drawing from a scene in Adam Ruins Everything. Highlighting the concept of rent-seeking behavior associated with tax filing software, Conover contrasts the streamlined processes observed in other countries with the unnecessary complexity of the U.S. system.

Share this post