Should the U.S. eliminate the penny? In this episode, we dive into the economics of keeping or removing the one-cent coin, weighing its production costs, impact on consumers, and whether rounding transactions would make a real difference. We explore arguments for and against, from inefficiencies at the cash register to the role of small change in charitable giving. We also discuss how other countries have handled similar transitions and whether the U.S. is ready to follow suit.

In this episode, we discuss:

The cost of producing a penny and whether it outweighs its usefulness.

How eliminating the penny could save time at the checkout counter.

Arguments for keeping the penny, including its role in charitable donations and impact on cash transactions.

How other countries, like Canada, have phased out low-denomination coins and what the U.S. could learn from them.

Whether removing the penny pushes the economy further toward a cashless society and how that affects unbanked individuals.

And a whole lot more!

Catch up on some old episodes:

You can also listen to us on Google Podcasts, TuneIn Radio, and Apple Podcasts. If one of these is your go-to podcast service, be sure to rate us and subscribe!

Watch this episode on YouTube:

Some show notes:

Aside from their presidential debate episodes, this might be the fastest turnaround Matt and Jadrian have had for recording. They’re just a few days out from the episode’s release. Jadrian is about a month into the Spring semester, and Virginia Tech called a snow day, giving him time to enjoy a brew from Hardywood Brewery in Richmond: Christmas Pancakes. Meanwhile, Matt is still in the office, so he opted for a classic caffeine-free diet cola to wrap up the workday.

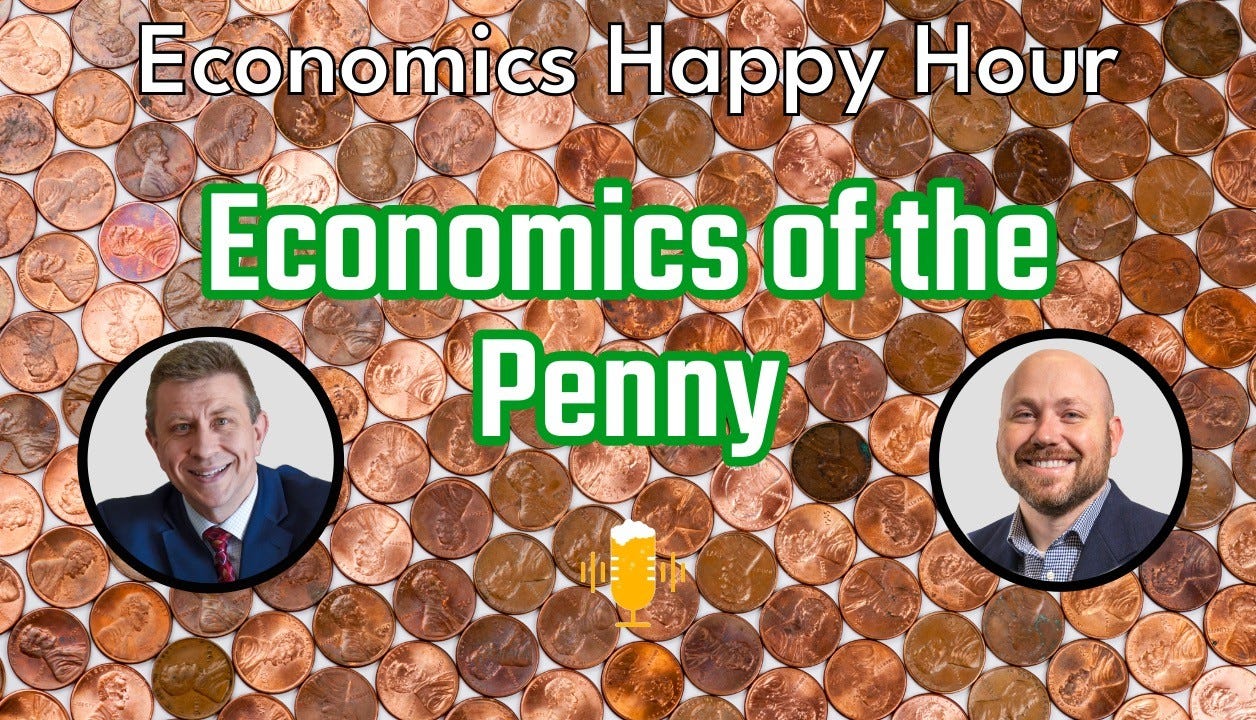

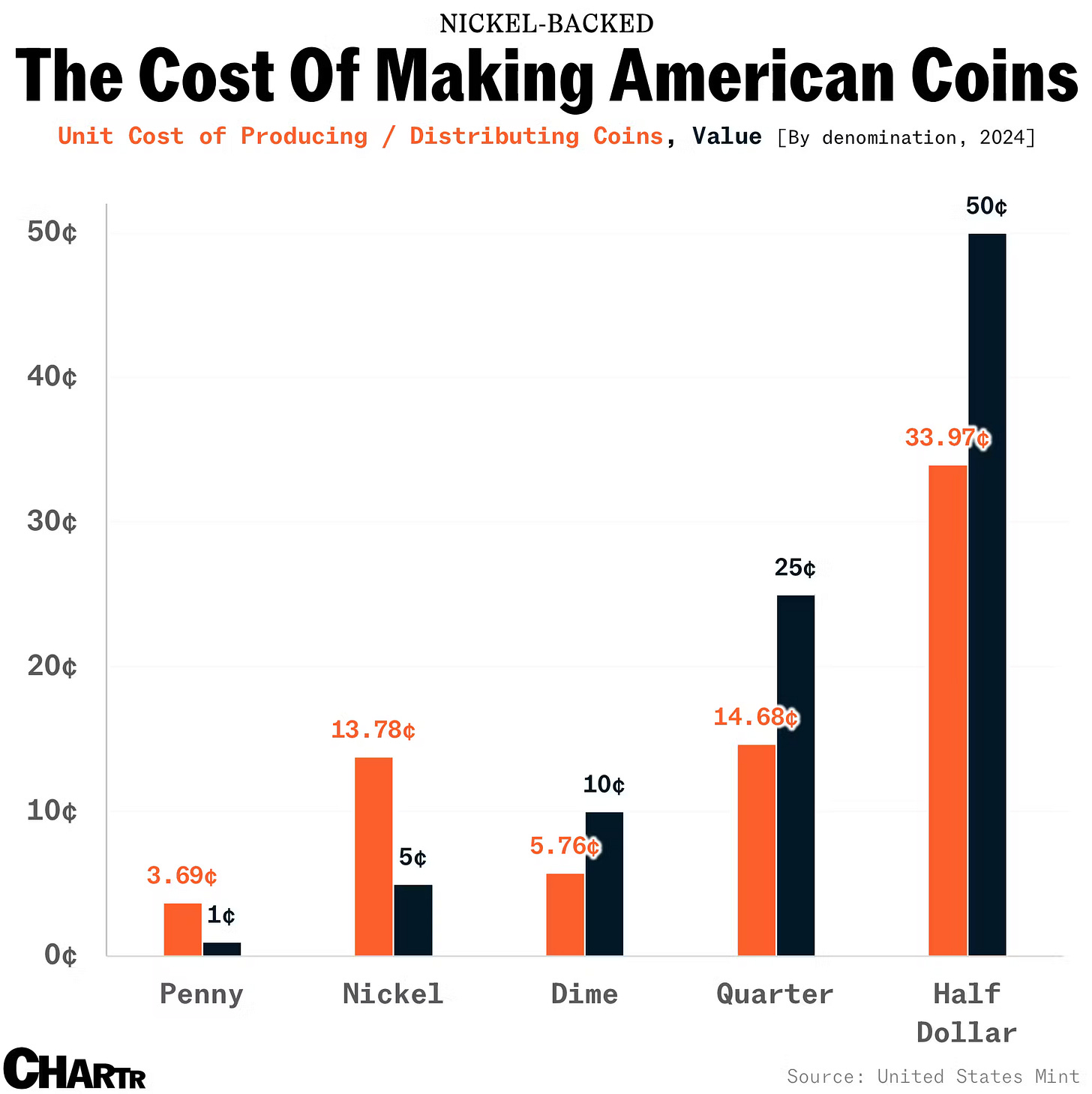

Today’s topic comes in response to a recent announcement by President Trump to pause the production of the penny. The debate over whether to eliminate the U.S. penny has been around for years, but this marks the first official step toward ending its production. One of the most common concerns is cost—each penny costs about 3.7 cents to produce, making it a financial loss for the U.S. Mint. While some argue that the penny’s longevity offsets its cost, we explore whether its declining use and low purchasing power make it more of a burden than a benefit.

Jadrian came into the discussion in favor of keeping the penny, but Matt’s strongest argument centers on opportunity cost. Cash transactions that involve pennies take extra time, whether it’s customers counting out exact change or cashiers handling small coins. Over millions of transactions, those extra seconds add up, creating unnecessary delays. But how would eliminating the penny work in practice? We look at Canada’s approach, where cash transactions are rounded to the nearest five cents while electronic payments remain unchanged. Sometimes people lose a couple of cents, but other times they gain a few when prices round in their favor—ultimately balancing out over time, with neither businesses nor consumers consistently losing money.

Supporters of keeping the penny argue that small change still plays a role in charitable giving, with organizations like the Salvation Army and Ronald McDonald House benefiting from coin donations. There’s also concern about how eliminating the penny might impact unbanked individuals who rely more on cash transactions. Would removing it create an extra burden for these groups, or would the shift be minor, given the overall decline in physical currency use?

Beyond cash transactions, we also consider the broader implications of eliminating the penny—especially whether it pushes the U.S. further toward a cashless economy. While digital payments continue to grow, many people still rely on cash for everyday purchases. Would this be a small step toward phasing out more coins or just a long-overdue efficiency move? We leave the question open for debate.

This week’s pop culture references:

Matt connected this week’s discussion to the musical Half a Sixpence, which includes a lyric about half a sixpence being better than half a penny. While that line fits thematically, the song with the strongest economic lesson (according to Matt) is Money to Burn:

Matt also pointed out another Broadway connection—Hello, Dolly! features Penny in My Pocket, a song performed by David Hyde Pierce in the show's revival.

Jadrian was stumped at first but eventually brought up a scene from The Terminal with Tom Hanks. While Hanks’ character isn’t collecting pennies, he finds a way to make extra money by returning abandoned luggage carts to reclaim the deposit. It’s a clever reminder that coins still have monetary value, but the opportunity cost of retrieving a quarter—or a penny—might not always be worth the effort.

Share this post