Matt and Jadrian are joined by Brian O’Roark to discuss the implications of the Federal Reserve’s decision to keep interest rates higher for a longer period. They explore how elevated interest rates impact mortgages, car loans, and the real estate market while examining inflation expectations and economic growth. Through their conversation, they find the economics of interest rates involves a nice blend of micro and macroeconomic analysis.

In this episode, we discuss:

How the Federal Reserve uses interest rate adjustments to influence inflation and economic growth.

The effects of higher mortgage rates on home-buying behavior and the slowing real estate market.

The interplay between interest rates, consumer saving habits, and borrowing behaviors.

How individual economic actions contribute to broader macroeconomic trends.

And a whole lot more!

Catch up on some old episodes:

You can also listen to us on Google Podcasts, TuneIn Radio, and Apple Podcasts. If one of these is your go-to podcast service, be sure to rate us and subscribe!

Watch this episode on YouTube:

Some show notes:

It’s the end of the semester, so the drinks were an important component of this episode. Jadrian is still in the process of cleaning out his fridge, so he digs deep to grab a peanut butter fudge golden stout by Rusty Rail Brewing Company. Meanwhile, Brian keeps things simple (and on theme) with a Long Island Iced Tea. Matt went with a pour from his growler, an Idaho 7 IPA from Marzoni’s. Brian made a long island iced tea.

The episode kicks off with a conversation about the Federal Reserve's role in managing inflation and economic growth through interest rate adjustments. The three of us discuss the implications of the Fed keeping interest rates “higher for longer” due to persistent inflationary concerns. Higher interest rates influence the availability of money in circulation, affecting borrowing costs for consumers and businesses alike. The federal funds rate was near zero for two years after the pandemic but is now back at the same level as it was during the Great Recession.

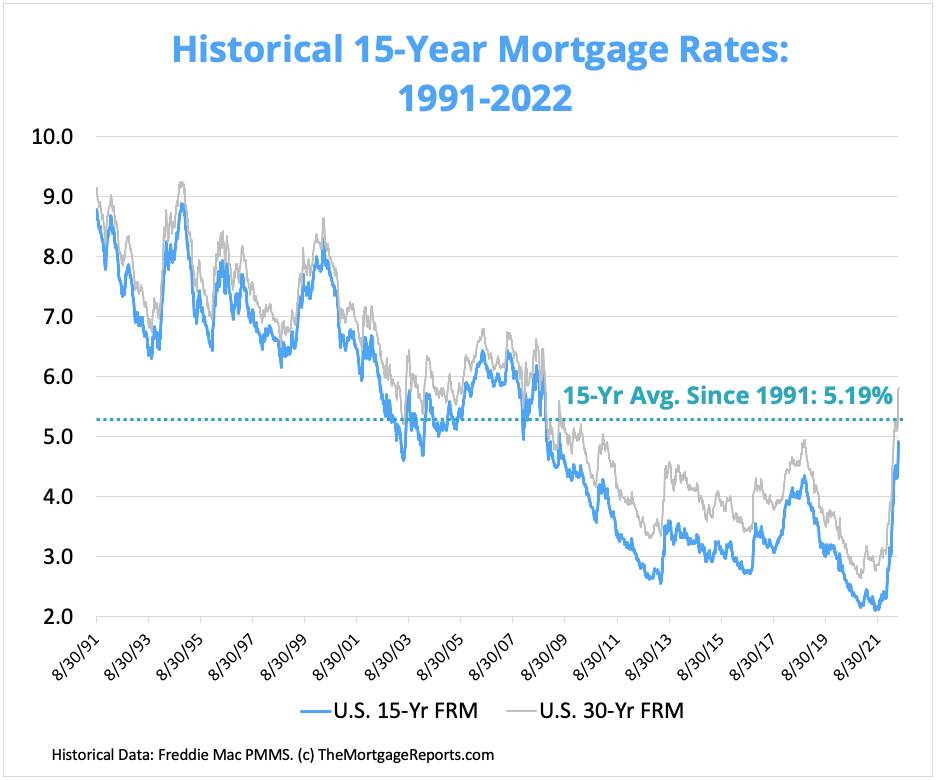

A significant portion of this episode is dedicated to understanding how elevated interest rates impact the real estate market. Higher mortgage rates slow down home-buying activity and gum up the real estate market, as current homeowners are reluctant to sell and take on significantly more expensive mortgages.

This dynamic leads to reduced market liquidity and challenges potential buyers in finding affordable housing options. But is this an issue in the grand scheme of history or just recent history? We may perhaps just be reverting to the average interest rate after years of below-average rates.

Higher interest rates affect the saving and borrowing behaviors of firms and households. Increased rates incentivize saving due to higher returns but simultaneously make it more expensive to borrow. This balancing act has profound implications for consumer spending, business investments, and overall economic activity.

Inflation expectations play a crucial role in shaping consumer behavior, and anticipated inflation can lead to self-fulfilling economic downturns. Some pundits are throwing around the notion that this is the start of a period of stagflation, where low economic growth coincides with high inflation. Jadrian hates reactionary punditry like this and invites Brian and Matt to consider what this might mean for the state of the economy.

This week’s pop culture references:

Jadrian brought up a song about the 1973-1975 recession, called Let the Dollar Circulate by Billy Paul. This 1970s funk-inspired track provides a retro, lighthearted take on a challenging economic period. It offers both a historical and cultural perspective on past inflationary periods and economic downturns. Check out more on the Economics Media Library.

Brian introduced a scene from The Simpsons where Mr. Burns gets his hands on the world’s only $1 trillion bill. He’s tired of all the rules and regulations in the United States, so he heads down to Cuba instead. Fidel Castro confiscates the money and redistributes it to Cubans. Communism continues to thank Mr. Burns.

Matt with Season 5 of Game of Thrones, where Mace Tyrell discusses the ethics of charging interest on loans. Even though the episode didn’t talk about the impact of the rates themselves, the clip highlights the moral dilemmas around lending and borrowing practices. It’s an interesting way to think about the history of usury and the repugnance with which some cultures view interest rates.

Thanks again for listening/watching — we appreciate your support!

Share this post